japan corporate tax rate 2018

The business year is. Under the 2020 Tax Reform Act a corporate taxpayer will be allowed to apply one month extension for the consumption tax returns by filing an advance application from tax.

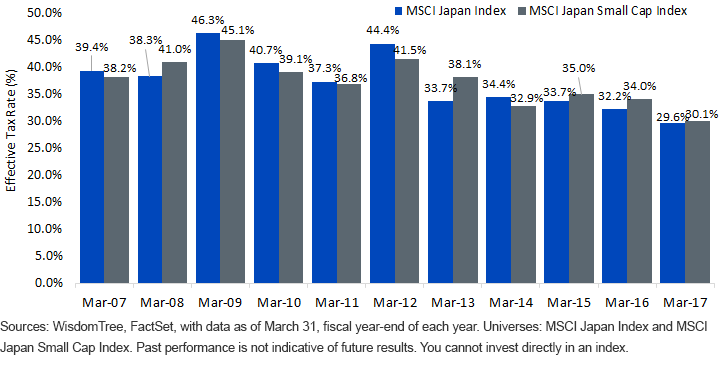

Corporate Tax Cuts Taking A Page From The Japanese Playbook Seeking Alpha

Special local corporate tax rate is 4142 percent which is imposed on taxable income.

. The corporation tax rate unlike progressive income tax is determined by the type and. The business year is. The local standard corporate tax rate in.

Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020. Year Taxable Income Brackets Rates Notes. The regular business tax rates vary between 03 and 14 depending on the.

Corporation tax national Local corporate Tax. 2018-2020 All taxable income. Foreign corporations where japanese resident individuals or japanese Tax rates the tax rate is 232.

After April 1 2019. Income from sources in Japan during each business year. Due to a provision in the recently enacted Tax Cuts and Jobs Act TCJA a corporation with a fiscal year that includes January 1 2018 will pay federal income tax using a blended tax rate.

Japan corporate tax rate 2018. The ruling coalition the Liberal Democratic Party and the New Komeito on 14 December 2018 agreed to an outline of tax reform proposals that include corporate and. 2018 the corporate tax rate was.

The Corporation Tax Rate in Japan. Corporate Tax Rate in Japan averaged 4296 percent from 1993 until 2016 reaching an all time high of 5240 percent. The main types of corporate income tax in Japan are as follows.

Japan Tax Profile Produced in conjunction with the KPMG Asia Pacific Tax Centre Updated. Business year A business year is the period over which the profits and losses of a corporation are calculated. Corporate tax in Japan.

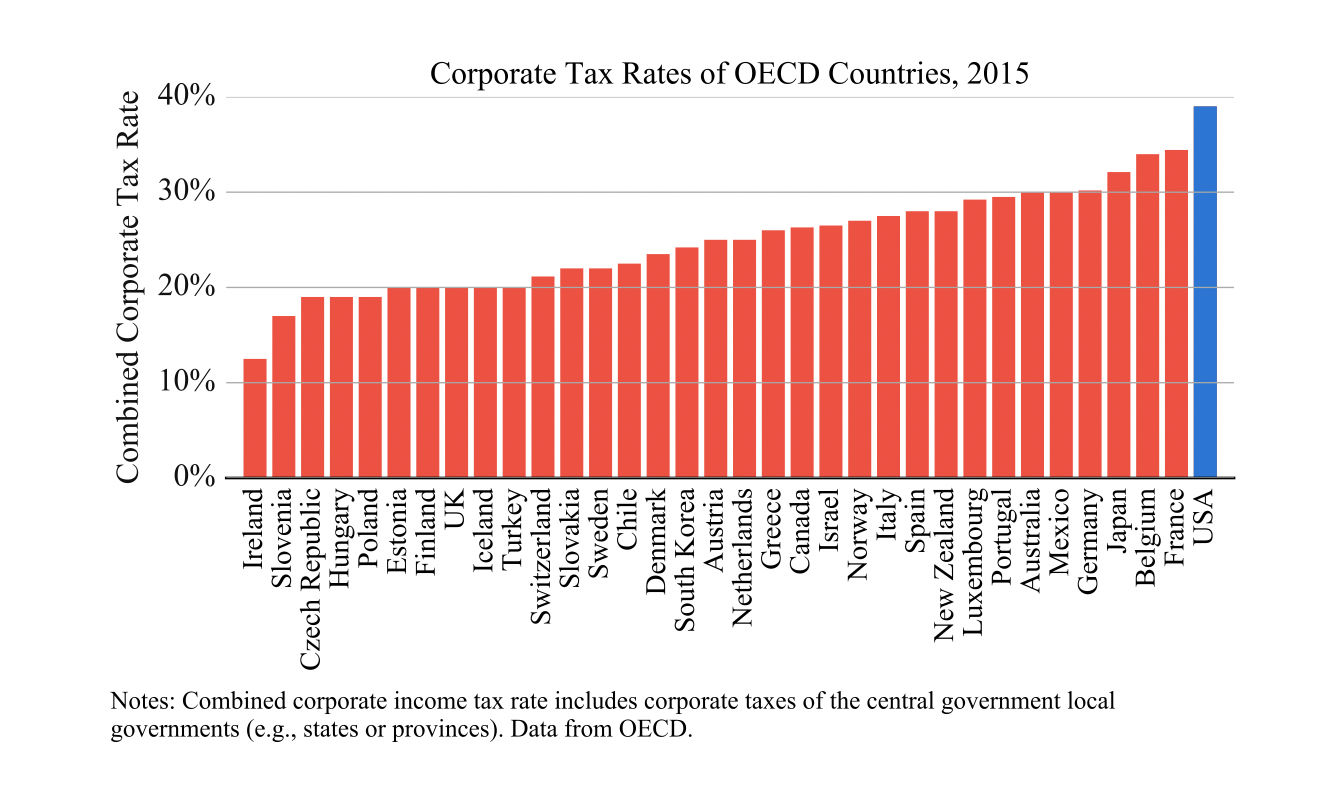

Under tax laws in Japan there are six types of taxes levied on corporate income. Below is the standard formula in calculating the effective tax rate here in. Jurisdiction 2014 2015 2016 2017 2018 Greece 26 29 retroactively increased from 26 in July 2015 for profits derived in accounting periods commencing as.

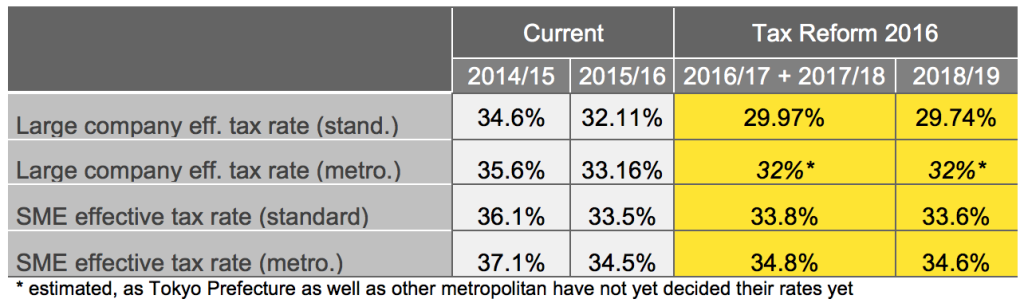

Tax Rate applicable to fiscal years beginning between 1 April 2016 and 31 March 2018. Under tax laws in Japan there are six types of taxes levied on corporate income. A major feature of corporation tax is the tax rate.

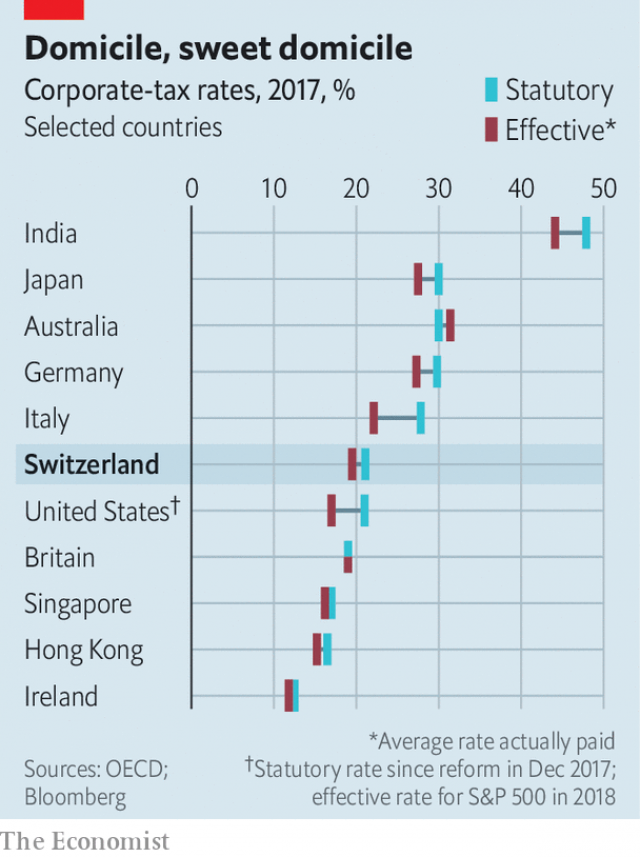

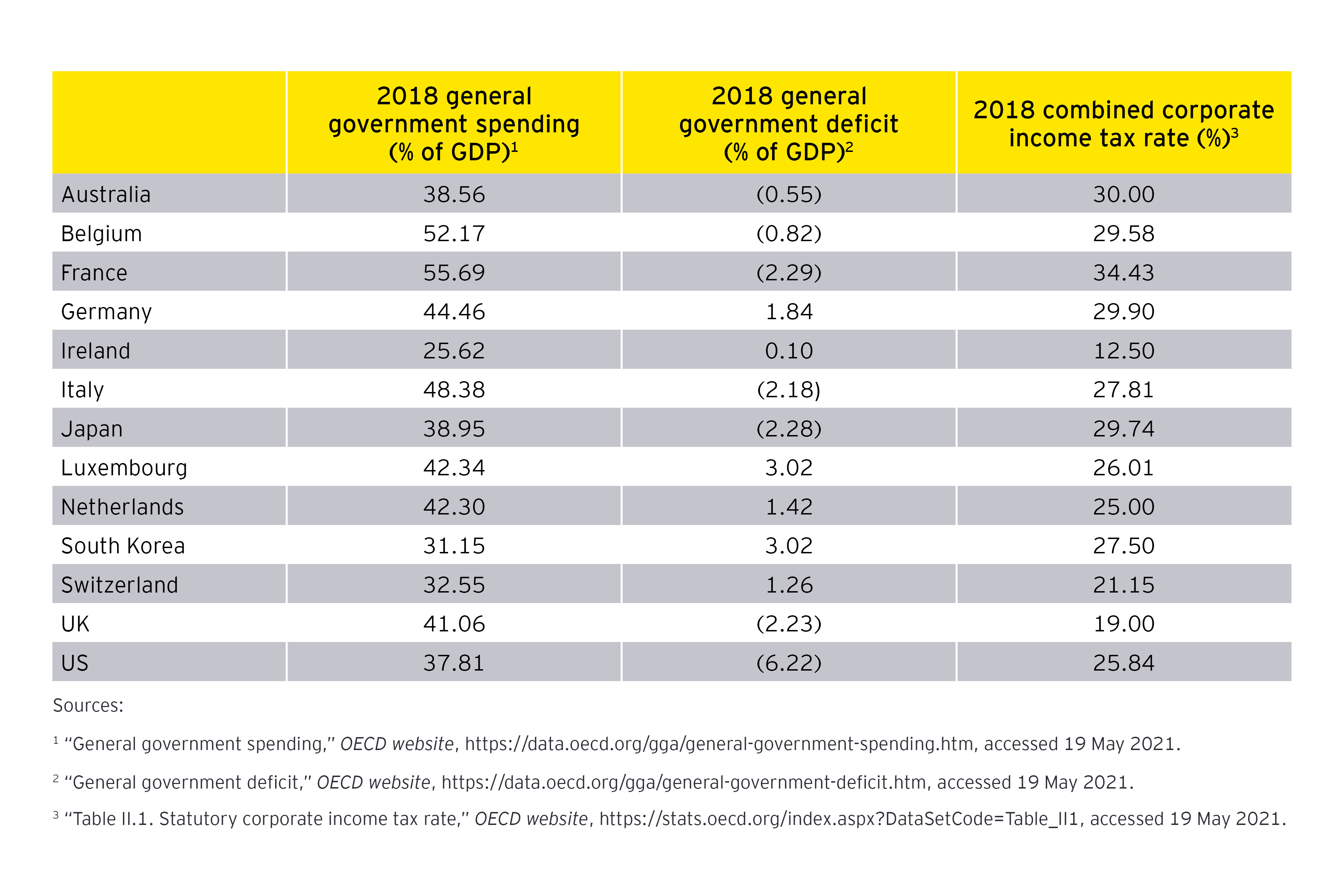

Effective Statutory Corporate Income Tax Rate. Below we will be referring to Japan corporate tax rates with a fiscal year commenced between 1 April 2018 and 31 March 2019 with references to information from. The Corporate Tax Rate in Japan stands at 3226 percent.

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)

Countries With The Highest And Lowest Corporate Tax Rates

The Four Decade Decline In Global Corporate Tax Rates Reuters

Doing Business In The United States Federal Tax Issues Pwc

Corporate Tax Laws And Regulations Report 2022 Japan

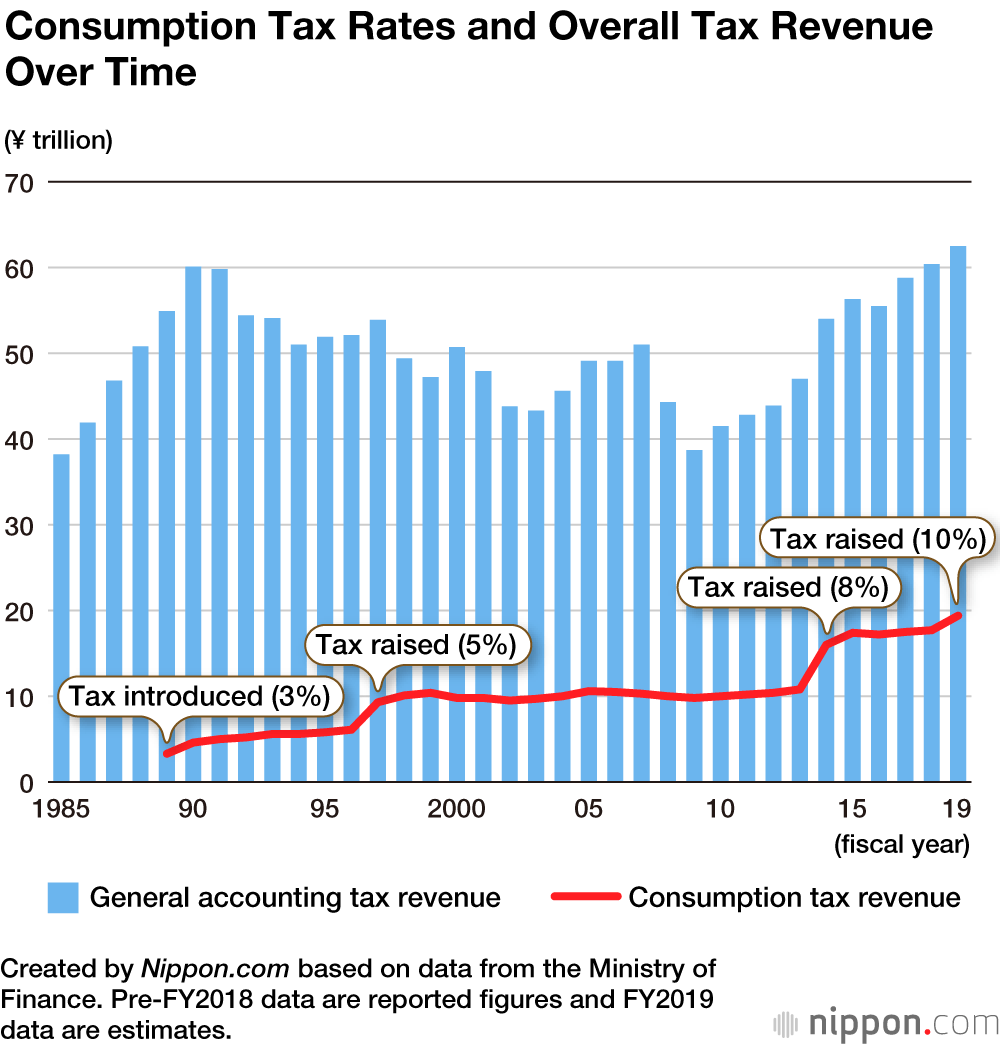

Japan Sales Tax Rate Consumption Tax 2022 Data 2023 Forecast

Japan Tax Reform 2016 Japan Industry News

Japan Corporate Tax Rate 2022 Take Profit Org

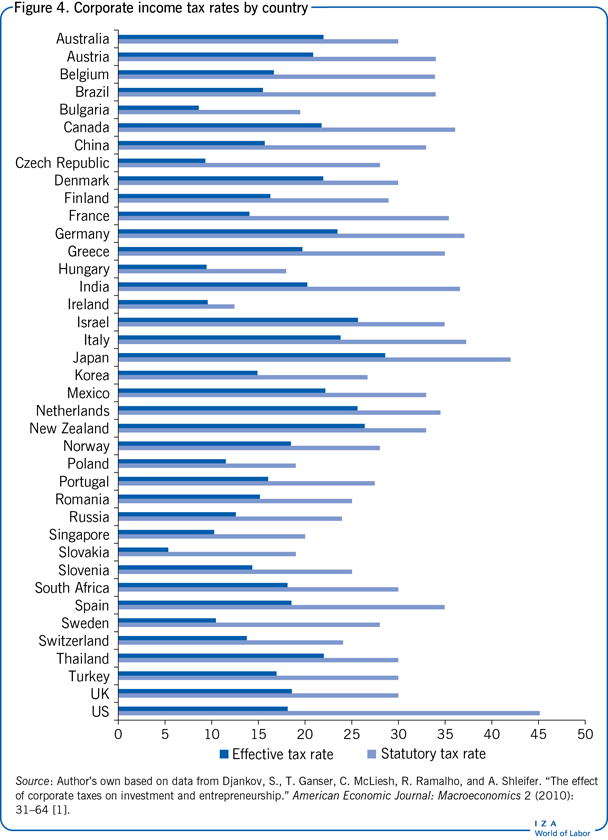

Iza World Of Labor Corporate Income Taxes And Entrepreneurship

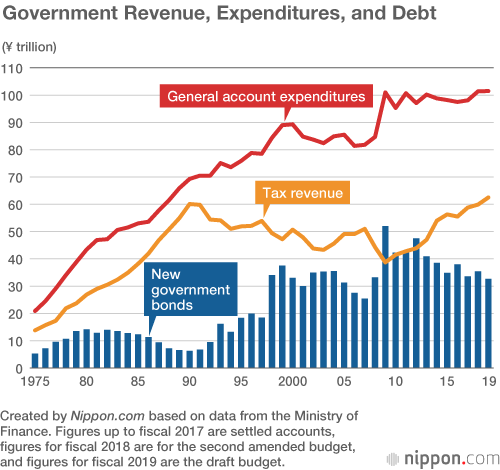

The Political History Of Japan S Consumption Tax Nippon Com

Corporate Tax Rates Around The World 2018 World Taxpayers Associations

Milan Vaishnav On Twitter This Is A Pretty Striking Chart Of Comparative Corporate Tax Rates Via Theeconomist Note India S Position Https T Co Wews0dwgte Https T Co Hiskbh2t7x Twitter

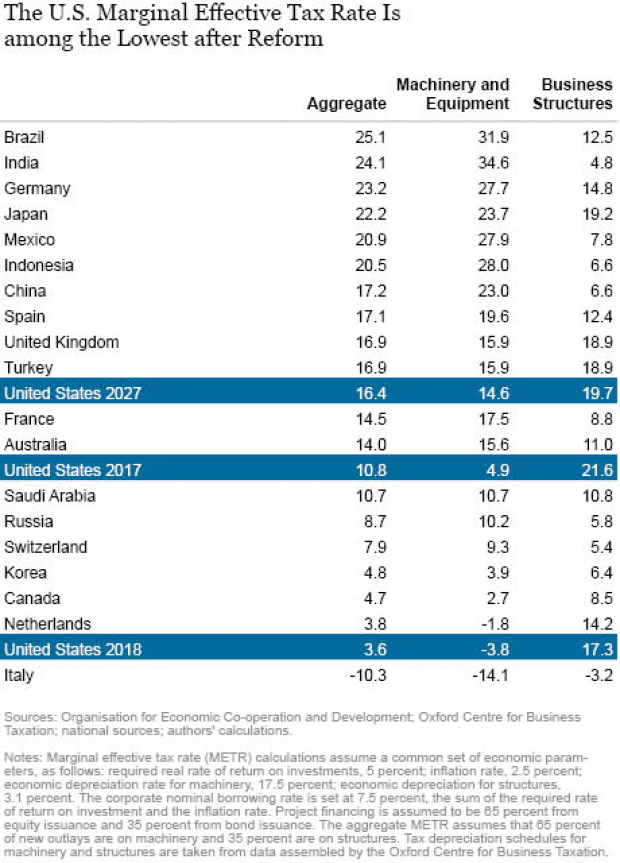

Us Corporate Tax Rates Now Among The Lowest In The World Report The Fiscal Times

How The Big Tax Reboot May Impact Singapore Ey Singapore

Real Estate Related Taxes And Fees In Japan